What is BRSR and how it is changing the Indian reporting landscape?

Share

Share

Copy Url

Copy Url

Changing the Indian reporting landscape

Climate change management has gained momentum across the globe. From urging companies to increase Electric Vehicles (EVs) in their portfolio mix, setting net-zero emission targets, and exploring circular economic models, protecting the earth has become the need of the hour. In addition to this global trend, investors and stakeholders are scrutinizing companies to conduct business responsibly without impacting the environment.

Hence, a company’s need to disclose sustainability-related metrics has gained importance.

ESG reporting was introduced in India after the Ministry of Corporate Affairs (MCA) established Corporate Social Responsibility (CSR) guidelines in 2009. Since then, the Indian reporting landscape has continuously been evolving with the introduction of various reports including the Business Responsibility Report (BRR), Corporate Social Responsibility Report (CSR), Integrated Report (IR), and the National Guidelines of Responsible Business Conduct (NGRBC).

Further in 2021, the Securities and Exchange Board of India (SEBI) introduced a new sustainability reporting requirement for listed companies in its May 10, 2021 circular. Named Business Responsibility and Sustainability Report (BRSR), it requires companies to include Environmental, Social, and Governance (ESG) parameters as part of their annual reports. BRSR’s new reporting has been formulated by incorporating worldwide trends in ESG reporting.

The new BRSR replaces the existing Business Responsibility Report (BRR) after a study by the Indian Institute of Corporate Affair (IICA) and UNICEF found the information reported by companies in the BRR lacked clarity and accuracy. The new reporting aims to address the gaps in the BRR.

Currently, the top 1000 listed companies can publish the BRSR on a voluntary basis for FY21-22; however, the SEBI has made it mandatory from FY22-23.

The BRSR requires listed companies to evaluate their performance against NGBRC’s nine principles:

- Conduct and govern with ethics, transparency, and accountability

- Provide products and services that are safe and contribute to sustainability throughout their lifetime

- Promote well-being for all employees including members across the value chain

- Respect interests and be responsive toward stakeholders, especially the disadvantaged, marginalized and vulnerable

- Respect and promote human rights

- Respect and make efforts to protect and restore the environment

- Engage responsibly when influencing public and regulatory policy

- Support inclusive growth and equitable development

- Engage and provide value to customers responsibly

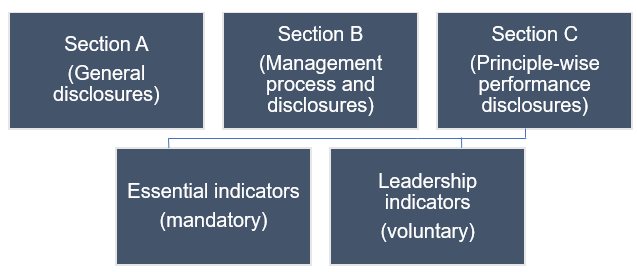

Structure of BRSR

Section A (General disclosures)

Contains basic information including the products or services and expands to add details such as operations, employees, holding, subsidiary and associate, companies (including joint ventures), CSR, transparency, and disclosure compliance

Section B (Management and process disclosures)

Contains questions related to policy and management processes, governance, leadership, and oversight

Section C (Principle-wise performance disclosures)

Companies are required to report KPIs in accordance with the nine principles of the NGRBC under the two subcategories of essential and leadership indicators

- The essential indicators that are mandatory to report include information on training conducted, data on energy, emissions, waste generated, and social impact created by the company

- The leading indicators are voluntary disclosures and include Life Cycle Assessments (LCA's), conflict management policy, biodiversity data, energy consumption, Scope 3 emissions, and supply chain disclosures. However, according to the MCA Committee Report, questions in the leadership category could be shifted to the essential category in the near-term

The BRSR report is changing the Indian reporting landscape in multiple ways.

- It is simpler and includes quantitative disclosures, providing a complete granular view of the information.

- It explains companies’ value chain-related information as the study by IICA and UNICEF revealed that companies improperly disclose their supply chain-related information.

- Unlisted companies are encouraged to use a simpler version of the format to get started on sustainability reporting.

- The BRSR is in line with the SDG goals, enabling companies to evaluate their performance against the SDG targets.

BRSR is more comprehensive compared to BRR. As the SEBI has mandated the top 1,000 companies to publish a BRSR from FY23, companies must prepare for the new form of reporting. The SEBI mandate also nudges companies to conduct a materiality assessment to discover their ESG risks and start gathering relevant information on their sustainability practices to publish a full-fledged BRSR report.

Reporting social and environmental issues will strengthen a company’s position in the industry, help in new customer acquisition and expand the consumer base. It will also increase cash inflow into the company as numerous Asset Management Companies introduce ESG funds after evaluating a company’s ESG performance. A 2021 report by IBM Institute for Business Value (IBV) stated that 71% of job seekers preferred to work in environmentally responsible companies. Hence, through sustainability reporting, companies can retain their workforce as employees.

Today, companies are expected to run businesses more consciously and responsibly than ever and it is expected that BRSR will be a single-stop inclusive report for all sustainability-related disclosures for Indian companies.

If you would like to discuss your corporate reporting requirement, feel free to reach out to Report Yak, and we would be happy to draft a perfect report for maximum impact!

Related Posts

-

Integrated Reporting Made Easy For Modern Companies

annual reportAnnual Report design

+6

Dec 31, 2025Share

Copy Url

How To Adopt BRSR Guidelines For Success

Oct 15, 2025Share

Copy Url

Simplifying ESG Disclosure for Better Impact

corporate reportingenvironmental and social initiatives

+6

Aug 28, 2025Share

Copy Url