How to Create a Detailed Investor Report

Share

Share

Copy Url

Copy Url

An investor report isn’t just a simple document; it’s a key tool that shares important financial information with your stakeholders. Whether you’re in investor relations or senior management, knowing how to create a solid investor report is crucial. It not only boosts stakeholder engagement but also helps set the tone for your annual report. This ensures that everyone across different departments stays on the same page. In this article, we’ll explore what an investor report includes and how it plays a role in effective investor relations.

If you want to learn how to make an investor report that stands out, you’re in the right place. This article will walk you through everything you need to know about investor reporting, from its purpose to the key parts every report should have. We’ll also discuss how to present financial information clearly and make your investor report a strong tool for engaging stakeholders, including those in senior management. By the end, you’ll have a clear guide for creating an investor report that meets—and even exceeds—expectations.

What is Investor Reporting?

Investor reporting is a key part of how companies share financial information with their investors. It means regularly updating investors on how their investments are doing. These updates include important details like earnings, revenue, and cash flows. This process helps keep things transparent, which is very important for strong investor relations. When companies keep investors informed, they build trust, create long-term relationships, and help investors make better decisions.

One main goal of investor reporting is to improve corporate governance. By sharing detailed information about how the company is performing, including financial reporting and risk assessments, companies help investors see how well the company is managed. This transparency is crucial for keeping investor confidence high and making sure the company follows integrated reporting standards. Investor reports are also a big part of the annual report. They give a full view of the company’s financial health, which is vital for both current and potential investors.

Good investor reporting also helps with stakeholder engagement. It lets senior management share the company's progress and plans across many channels. This ensures that all stakeholders are on the same page. Whether through quarterly updates or annual reports, these documents are key to managing investor expectations and helping them make informed decisions.

What is an Investor Report?

An investor report is a document that shares detailed information about a company’s financial performance and health, made specifically for its investors. It's an important tool in financial reporting. It helps investors look at the company’s earnings, revenue, and other key financial details. By giving a clear overview of the company’s financial situation, an investor report helps investors decide whether to buy, keep, or sell their shares.

These reports usually include several key parts. They often have financial statements like the income statement, balance sheet, and cash flow statement. Together, these show the company’s financial status. The report may also summarize recent earnings, analyze market trends, and offer insights into the company’s future. This detail helps investors see both the current performance and the potential for future growth.

Investor reports also play a key role in keeping things transparent and building trust between a company and its investors. By regularly sharing accurate and timely information, these reports keep all stakeholders informed about the company’s progress and any challenges it faces. This is especially important for boosting investor confidence and keeping stakeholders engaged.

Why Organizations Must Release Investor Reports

Organizations must release investor reports for several key reasons. These reports play a crucial role. They maintain transparency, foster trust, and ensure that investors have all the information they need to make informed decisions. Here’s why investor reports are essential:

1. Promotes Financial Transparency

Releasing an investor report ensures financial transparency. It provides a clear view of the company’s financial health, including earnings and other critical metrics. This transparency does two things. It builds trust among investors and reassures them that the company is managing its finances responsibly.

2. Informs Investment Decisions

Investor reports offer a comprehensive overview of the company’s financial situation. This helps investors make informed decisions. By analyzing data on revenue, expenses, and financial stability, investors can determine whether to increase, decrease, or maintain their investments.

3. Strengthens Shareholder Relations

Regularly sharing investor reports strengthens relationships with shareholders. These reports keep shareholders informed about the company’s progress, earnings, and any dividends. The higher the earnings and dividends, the more they remain engaged and confident in their investment.

4. Demonstrates Business Performance

An investor report shows how different lines of business products and services are performing. This information helps investors understand where the company is thriving and where it might need to improve, offering insights into potential growth areas.

5. Supports Accountability

By releasing regular reports, companies hold themselves accountable to their investors. This accountability is crucial for maintaining investor confidence and ensuring the company’s long-term success in a competitive market.

By focusing on these points, companies can communicate their financial health and strategic direction to their investors. This supports informed decision-making and fosters a strong, trust-based relationship.

Key Elements of Every Investor Report

An investor report is essential for companies to communicate critical information about their financial health, performance, and future outlook to investors. These reports ensure transparency and help investors make informed decisions. Below are the key elements that every investor report should include:

Executive Summary

The executive summary provides a snapshot of the company's performance during the reporting period. It highlights major achievements, challenges, and plans. This section is crucial as it offers beneficial shareholders a quick overview of what to expect in the detailed report, helping them understand the company's current state and strategy.

Financial Statements

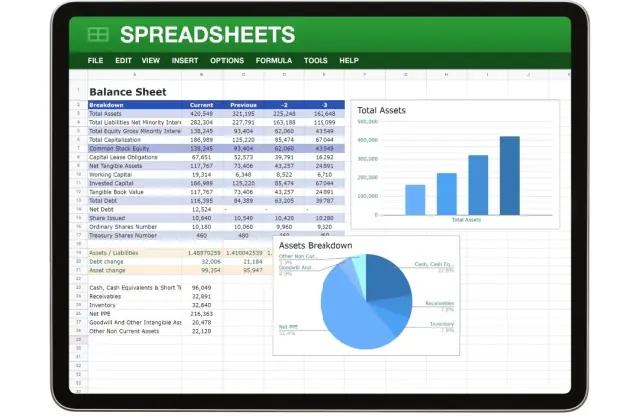

Financial statements are the backbone of any investor report. They include the income statement, balance sheet, and cash flow statement. These documents detail the company's earnings, expenses, assets, and liabilities, providing a clear picture of its financial position. This transparency is key for investors to assess the company's financial health and make informed investment decisions.

Dividend Information

Dividend details are important for shareholders who are interested in the income they earn from their investments. The investor report should outline the dividends paid during the reporting period, along with any changes to dividend policies. This information helps investors understand the return on their investment and the company's commitment to sharing profits.

Business and Product Updates

This section covers updates on the company’s products and services, including new launches, enhancements, and shifts in strategy. It also includes information on different lines of business. These updates are critical for investors to gauge how well the company is adapting to market changes and positioning itself for future growth.

ESG and Sustainability Reporting

An Environmental, Social, and Governance report, or ESG report, is increasingly becoming a standard part of investor reports. It highlights the company's efforts towards sustainability and inclusive growth. This section is essential for investors who focus on socially responsible investments. It provides them with insights into how the company manages its environmental and social impact.

Risks and Challenges

Transparency about potential risks and challenges is vital in maintaining investor confidence. The report should address any financial or operational risks that the company is facing and the strategies in place to mitigate them. This honesty helps build trust and reassures investors that the company is managing its challenges proactively.

These elements together make an investor report a comprehensive tool that not only informs but also engages investors, helping them to stay aligned with the company’s goals and performance.

How to Craft an Effective Investor Report

Creating a strong investor report is key to building trust, keeping transparency, and helping investors understand your company’s financial health and direction. Here are some simple tips to make your investor report clear and effective:

1. Start with a Clear Executive Summary

Begin your investor report with a short executive summary. This part should give a quick overview of your company’s performance. Highlight big achievements, challenges, and future goals. Mention any strategic initiatives you’ve taken and how they fit into your growth plans. This helps investors, including any member of the board, quickly understand the main points of the report.

2. Highlight Financial Performance

The financial performance section is a crucial part of the investor report. Cover important financial metrics like revenue, expenses, profit margins, and any big changes since the last report. Explain any big changes in earnings or other financial numbers. This transparency builds investor confidence.

3. Incorporate Sustainability and ESG Reporting

Investors today care about sustainability and ESG (Environmental, Social, and Governance) practices. Include a section in your report that talks about your company’s efforts in these areas. Show how these efforts contribute to inclusive growth. This meets investor expectations and aligns with market trends.

4. Detail Dividend Payments

If your company pays dividends, include a section on dividend payments made during the period. Explain why you chose this dividend policy and how it reflects your company’s financial health. This is important for investors who focus on income from their investments.

5. Include Visuals for Clarity

Use charts, graphs, and other visuals to make financial data easy to understand. Visuals can make complex information clearer and more engaging. This improves the transparency of your report.

6. Ensure Regulatory Compliance

Make sure your investor report follows all relevant regulations, like those set by SEBI or other governing bodies. This not only keeps your report legal but also shows your commitment to transparency and ethical practices. Following these rules helps build trust with your investors.

By using these tips, you can create an investor report that clearly shows your company’s financial health and commitment to transparency, sustainability, and strategic growth. This will help you maintain strong investor relations and support your long-term business goals.

Report Yak: Designing Investor Reports that Stand Out

Crafting a detailed and effective investor report is essential for maintaining transparency, building trust, and ensuring that your stakeholders are well-informed about your company’s financial health and strategic direction. A well-structured investor report not only highlights key financial metrics but also addresses important aspects like sustainability, ESG practices, and dividend payments. By incorporating visuals and adhering to regulatory compliance, you can create a report that is both comprehensive and engaging for your investors.

If you're looking to create investor reports that stand out, consider partnering with Report Yak, one of India's best report design agencies. Specializing in annual reports, investor reports, ESG reports, sustainability reports, and more, Report Yak has won several LACP Spotlight Awards. For samples of our award-winning work, visit the Showcase page on our website. For a full list of services, check out the Services page. Get in touch via feel free to WhatsApp us, call us at 1800 121 5955 (India), or email us at contact@reportyak.com. You can also fill out the Contact Form on our website, and we'll get back to you as soon as possible. Let Report Yak help you elevate your reporting to the next level.

Related Posts

-

Integrated Reporting Made Easy For Modern Companies

annual reportAnnual Report design

+6

Dec 31, 2025Share

Copy Url

How To Adopt BRSR Guidelines For Success

Oct 15, 2025Share

Copy Url

Simplifying ESG Disclosure for Better Impact

corporate reportingenvironmental and social initiatives

+6

Aug 28, 2025Share

Copy Url