IFRS Standards Explained: An Informative Guide for Global Companies

Share

Share

Copy Url

Copy Url

Dip into the world of IFRS standards and you will find a rulebook that speaks one clear language of money. Created by the International Accounting Standards Board (IASB), these guidelines help businesses and investors read numbers without a phrasebook. They shape financial statements across borders, pushing companies to report the same way whether they sell tea in Delhi or tech in Dublin. When firms follow them, users see a true picture of financial performance and position, and trust grows.

In this article, we keep things friendly while we unpack the heavy stuff. First, we show the role of IFRS in global reporting and why a common code matters more than ever. Next, we walk through a complete list of these standards so you can spot the rule that fits your ledger line. Then we zoom in on financial instruments under key IFRS standards, because swaps and bonds deserve clarity too. After that, we map companies' steps to adopt IFRS, from gap checks to system tweaks. Along the way, we look at how the framework links to sustainability reporting, nudging ethical business practices, and clear maths. Stick with us to learn how adopting IFRS leads to smooth compliance and cleaner numbers that sparkle in boardrooms and beyond.

The Role of IFRS in Global Reporting

Long before anyone called them IFRS standards, accounting leaders worried that one nation’s profit might look like another’s loss. In 1973, they formed the International Accounting Standards Committee; by 2001, the baton passed to today’s International Financial Reporting Standards (IFRS), set by the IASB. Their core promise is simple—use the same definitions everywhere to ensure transparency. Investors, auditors, and taxpayers can then see what sits on a balance sheet.

That promise explains why the global financial landscape now counts more than 140 jurisdictions that mandate or permit the adoption of IFRS in public filings. A shared rulebook slashes translation errors, eases cross-border listings, and lets analysts trust ratios at first glance. Consistent rules also reduce quarrels over interpretation. When revenue or debt means the same thing everywhere, confidence grows among investors, lenders, and regulators.

Key Benefits in Practice

Clarity for Capital Providers

IFRS standards give investors and lenders one yardstick. When every statement speaks the same language, users compare profits and risks quickly, then act with confidence. Uniform data cuts guesswork and helps watchdogs spot problems early, boosting trust across markets.

Lower Reporting Costs

Using one rulebook ends duplicate ledgers. Multinationals drop parallel records for each country, saving audit fees, staff hours, and software costs. New IFRS 19’s trimmed disclosures deepen those savings while keeping information useful for readers.

Easier Access to Capital

Shared rules make overseas listings smoother. A company can raise funds abroad without rewriting accounts. Lower barriers attract diverse investors and enlarge credit lines, letting firms fund growth while markets enjoy richer liquidity.

Sharper Regulatory Oversight

Clear IFRS requirements define assets, liabilities, and revenue. Regulators spend less time debating labels and more time tackling real risks. Swift, objective checks protect savers and lift the credibility of the financial system.

Integrated Sustainability Insight

The IASB now links accounting rules with ISSB climate standards. Firms can fold carbon numbers into their usual reports, creating a single framework for financial reporting that balances profit with planet. Investors see both stories side by side.

Complete List of IFRS Standards Explained

Below sits a handy index of IFRS standards, the global playbook born in London and established in 2001. Whether you prepare company financial statements in Nairobi or Nagoya, this quick guide shows how every rule plugs into the wider framework for financial reporting, and why investors still cheer.

IFRS 1 – First-time Adoption of IFRS

Helps firms shift from local Generally Accepted Accounting Principles (GAAP) to IFRS accounting standards smoothly. It sets one-off adjustments so figures remain comparable, ensuring consistency and compatibility.

IFRS 2 – Share-based Payment

Requires companies to record the fair value of shares and options granted to staff. The cost lands in profit or loss, so the pay looks real.

IFRS 3 – Business Combinations

Tells buyers how to measure assets, liabilities, and goodwill on day one. Clear rules help investors judge whether a takeover makes sense.

IFRS 4 – Insurance Contracts

A stop-gap that asks insurers to reveal risk and future cash flows until IFRS 17 takes full effect. Disclosure steadies confidence in solvency.

IFRS 5 – Non-current Assets Held for Sale

Moves assets for sale into a separate bucket and halts depreciation. The split lets readers track continuing results cleanly.

IFRS 6 – Exploration for and Evaluation of Mineral Resources

Allows miners to keep exploration costs capitalised but demands timely impairment tests. Investors follow drilling spend without guesswork.

IFRS 7 – Financial Instruments: Disclosures

Requires detail on credit, market, and liquidity risk. These notes ensure transparency about exposures lurking off the main statements.

IFRS 8 – Operating Segments

Breaks down results by how top managers view the business. Segment data shows which units truly drive cash.

IFRS 9 – Financial Instruments

Sets classification, measurement, and expected-credit-loss rules. Forward-looking impairments curb nasty surprises when customers can’t pay.

IFRS 10 – Consolidated Financial Statements

Defines control and drags hidden subsidiaries on the balance sheet. Users get the full group picture, no matter the structure.

IFRS 11 – Joint Arrangements

Splits joint operations and ventures, guiding recognition. Clear labels stop partners from double-counting shared assets.

IFRS 12 – Disclosure of Interests in Other Entities

Bundles all interest disclosures in one spot—from associates to unconsolidated structures. Readers trace links that influence cash.

IFRS 13 – Fair Value Measurement

Creates one rules-based hierarchy, replacing many old methods from IAS days. Consistent metrics aid valuation debates across sectors.

IFRS 14 – Regulatory Deferral Accounts

Lets first-time adopters keep local deferral balances after transition. Analysts can still reconcile numbers without chaos.

IFRS 15 – Revenue from Contracts with Customers

Uses a five-step model to recognise income as obligations finish. Fits everything from software licences to skyscraper builds.

IFRS 16 – Leases

Brings most leases on-balance sheet as right-of-use assets. The shift aligns lease finance with other borrowing.

IFRS 17 – Insurance Contracts

Replaces IFRS 4 with a single model that spreads profit as service is delivered. Comparable measures lift confidence in insurers’ equity.

IFRS S1 – General Requirements for Sustainability-related Financial Information

Sets baseline disclosures on social and environmental risks, tying them to the financial information users need. Links financial statements across different markets with impact data.

IFRS S2 – Climate-related Disclosures

Adds detailed climate metrics and targets that dovetail with S1. Together, they sit beside other IFRS standards to show climate costs without extra spreadsheets.

Note: Many older IAS pronouncements still guide topics not yet updated; think IAS 7 for cash flows or IAS 2 for inventories. Where local law defers to them, preparers keep using those papers until a newer IFRS replaces them, just as national GAAP once did. For more details on the IFRS Sustainability Disclosure Standards, click the link.

Financial Instruments Under Key IFRS Standards

These IFRS standards tackle how companies show loans, swaps, and more in their books. Below, we explore the top rules in bite-sized pieces.

IFRS 9

This standard modernizes how firms handle loans and swaps.

Recognition & Measurement: Uses a forward-looking expected-credit-loss model for trade receivables.

Presentation: Classifies assets and liabilities by business model and cash-flow traits.

Disclosure: Requires risk-sensitivity tables showing credit, market, and liquidity exposures.

IFRS 7 & IAS 32

These standards guide risk notes and split equity from debt.

Recognition & Measurement: IAS 32 tells whether an instrument is a liability or equity based on the cash obligation.

Presentation: Offsetting works only when you meet strict netting rules.

Disclosure: IFRS 7 needs maturity, credit, and market risk tables.

IFRS 13

This standard sets one ladder for fair value and, in 2024, adds narrow amendments for power-purchase contracts.

Recognition & Measurement: Defines fair value as the exit price at measurement date.

Presentation: Fair-value items appear under separate headings with hierarchy levels.

Disclosure: Shows Level 1–3 inputs and sensitivity analysis.

IFRS 16

This standard treats lease debts as financial liabilities.

Recognition & Measurement: Entities record the present value of lease payments as a liability.

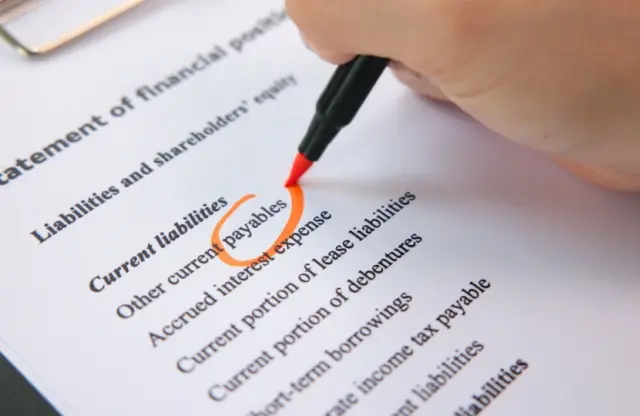

Presentation: Lease liabilities and right-of-use assets sit side by side on statements.

Disclosure: Firms show maturity schedules and interest expense for each lease.

Tip: Auditors should test automated data feeds for IFRS standards and compare raw market prices to reported valuations. Daily reconciliations and regular log reviews help catch glitches, ensuring reliable audit trails.

Steps Companies Take to Adopt IFRS

Moving to IFRS standards replaces local rules with a global code. The IFRS Foundation and its principles-based approach guide firms toward clear reporting. These International Financial Reporting Standards level the playing field for every firm. Here’s a five-step roadmap to plan your smooth switch.

Step 1: Run a Gap Analysis

First, run a gap analysis between local GAAP and IFRS to spot key differences. This comparison of each set of accounting standards highlights gaps. It uncovers how rules diverge, ensuring consistency and comparability for your numbers.

Step 2: Update Policies and Convert Data

Next, revise policies so your company’s financial records match IFRS rules. Then convert past data on all financial transactions. Clear journals help map old entries to new categories.

Step 3: Upgrade Systems and Tools

Then, upgrade your ERP and reporting tools. Embed IFRS standards and global financial standards into templates and dashboards. Automate routine reports. These tweaks improve accuracy in all aspects of financial reporting.

Step 4: Train Teams and Pilot Runs

Next, train staff on each new requirement and process. Schedule pilot runs to test real scenarios. Map every line requiring companies to disclose under IFRS. Collect feedback and fix glitches fast.

Step 5: Phase Go-live and Brief Stakeholders

Finally, roll out IFRS in phases. Share clear timelines with auditors, bankers, and boards. Use International Sustainability Standards Board insights for climate disclosures. This staged launch secures buy-in and ensures compliance with IFRS.

Report Yak: Turning IFRS Data Into Stories

Your figures already comply—let us make them sing. Clear layouts, crisp infographics, and plain English help readers trust your IFRS-compliant numbers. A well-designed profit and loss section feels approachable. A clean statement of financial position page stops confusion. Visual highlights guide eyes to key metrics. They bridge the gap between complex data and clear insight. Plain-English headings cut jargon and invite engagement.

Report Yak turns pages of dense tables into simple charts. We follow regulatory formatting rules so your reports pass muster in 140 countries and stand out in global capital markets. Our designers break big blocks into icons, colour bands, and callouts. Readers find answers fast. Audit teams find fewer footnotes when hunting. This boosts readability and cuts review time by up to 30%.

We’ve worked with high-profile clients to craft annual, sustainability, and ESG reports. We also design other financial reports (for example, half-yearly reports, business intelligence reports) that look sharp and read clearly. Imagine your next report with dynamic dashboards, interactive summaries, and plain-language captions. Your stakeholders will spend less time decoding and more time on decision-making.

Ready for a fresh look? Book a free mock-up call this week. Check out our work. Dial our toll-free number 1800 121 5955 (India). You can also email us, drop a WhatsApp, or fill out the Contact form.

Related Posts

-

Integrated Reporting Made Easy For Modern Companies

annual reportAnnual Report design

+6

Dec 31, 2025Share

Copy Url

Simplifying ESG Disclosure for Better Impact

corporate reportingenvironmental and social initiatives

+6

Aug 28, 2025Share

Copy Url

GRI Sustainability Taxonomy: Learn How to Turn Data Into Advantage

corporate governancecorporate reporting

+11

Jul 1, 2025Share

Copy Url