ESG Metrics: An Important Key to Competitive Advantage

Share

Share

Copy Url

Copy Url

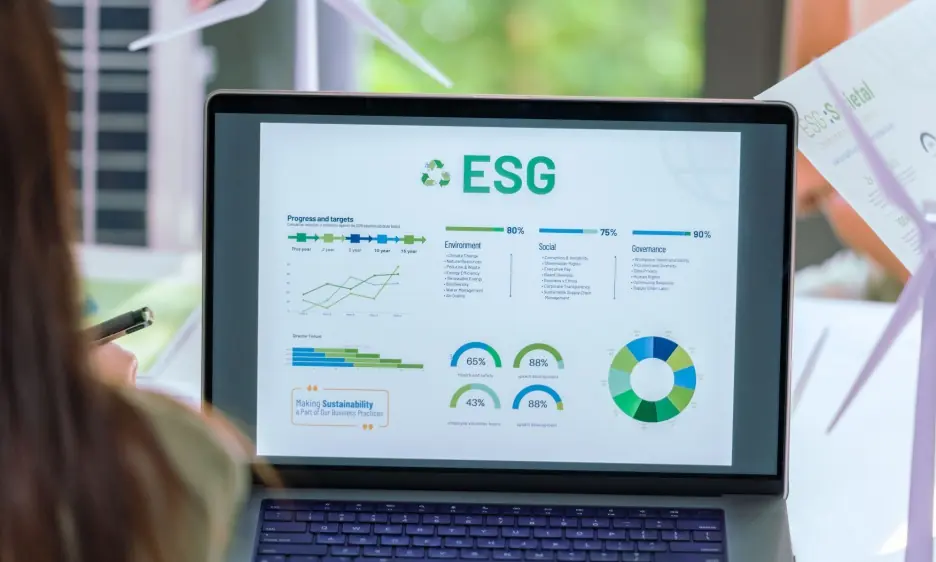

ESG metrics help businesses measure their commitment to sustainability and corporate responsibility. They track environmental impact and governance practices, offering a comprehensive view of ESG performance. Focusing on sustainability reporting, organizations use frameworks like the International Sustainability Standards Board (ISSB) and the Sustainability Accounting Standards Board (SASB) for consistency and transparency. With a strong reporting framework, companies can align their goals with global standards and show their commitment to corporate sustainability.

But what are ESG reporting metrics, and why do they matter? Beyond compliance, they provide insights into a company's social and environmental performance. These insights build stakeholder trust and support long-term success. Measuring ESG effectively also reveals opportunities to improve operations and strengthen reputation.

This article explains ESG metrics, their importance, and their key categories: environmental, social, and governance. It also explores their implementation, commercial benefits, and common challenges, offering practical solutions.

Understanding ESG Metrics

In today's business world, ESG metrics are vital for evaluating a company's commitment to sustainability and ethical practices. They assess how well a company manages its environmental, social, and governance responsibilities.

Definition and Scope

ESG metrics are quantitative and qualitative indicators that assess a company’s environmental impact, social responsibility, and governance. They provide a detailed view of a company’s ESG performance, helping stakeholders understand its dedication to sustainability.

Importance in Modern Business

ESG metrics are crucial for businesses today. They offer insights into how companies address risks and opportunities related to sustainability and ethical practices. Strong ESG performance can shape investor decisions and influence stakeholder perceptions. It can also impact a company's reputation and financial success.

In the European Union, the Corporate Sustainability Reporting Directive (CSRD) requires companies to disclose their ESG performance. This highlights the need for transparency in ESG disclosures. In India, ESG reporting is also growing in importance. Companies must follow the Business Responsibility and Sustainability Reporting (BRSR) framework set by the Securities and Exchange Board of India (SEBI).

This framework aligns sustainability reporting in India with global practices. It ensures consistency and accountability in ESG disclosures. Global frameworks like the International Sustainability Standards Board (ISSB) and the Sustainability Accounting Standards Board (SASB) also guide Indian companies. These help align their ESG goals with international standards.

By following these frameworks, businesses can ensure transparent and consistent reporting. This allows them to communicate their ESG initiatives and performance to stakeholders. Adhering to these standards strengthens India’s commitment to sustainability and boosts global competitiveness.

Key ESG Metrics Categories

Understanding ESG metrics is crucial for companies aiming to enhance their sustainability and ethical practices. These metrics are important as they help businesses identify ESG risks and opportunities, ensuring long-term success.

Environmental Metrics

1. Greenhouse Gas Emissions

Monitoring greenhouse gas emissions, such as carbon dioxide and methane, is vital for assessing a company's environmental impact. The Greenhouse Gases (GHG) Protocol provides a widely used framework for measuring and managing these emissions. By tracking them, businesses can implement strategies to reduce their carbon footprint and adhere to global reporting standards.

2. Energy and Water Consumption

Tracking energy and water usage helps companies identify areas for efficiency improvements. Reducing consumption lowers operational costs and minimizes environmental impact, aligning with ESG goals.

3. Waste Management

Evaluating waste generation and disposal methods allows companies to implement recycling and reduction initiatives. Adopting a circular economy approach to plastic waste focuses on reusing and repurposing materials, reducing the reliance on single-use plastics. Effective waste management demonstrates a commitment to sustainability and can enhance corporate reputation.

4. Air Quality

Monitoring pollutants released into the atmosphere, such as sulfur dioxide and nitrogen oxides, helps assess a company's impact on air quality. Addressing these emissions is essential for regulatory compliance and community health.

5. Water Pollution

Assessing the discharge of harmful substances into water bodies enables companies to mitigate negative effects on aquatic ecosystems. Implementing proper wastewater treatment processes is crucial for environmental stewardship.

Social Metrics

1. Diversity and Inclusion

Assessing workforce composition on gender, ethnicity, and other factors ensures fair practices. Promoting diversity and inclusion fosters a positive work environment and drives innovation.

2. Employee Health and Safety

Monitoring workplace incidents and well-being programs is essential for maintaining a safe work environment. Prioritizing health and safety reduces absenteeism and increases productivity.

3. Community Engagement

Evaluating a company's involvement in local communities through initiatives like volunteering and philanthropy reflects its social responsibility. Active community engagement strengthens stakeholder relationships.

4. Labor Practices

Assessing fair wages, working hours, and employee rights ensures compliance with labor laws and ethical standards. Upholding fair labor practices enhances employee satisfaction and retention.

5. Customer Satisfaction

Measuring customer feedback and addressing concerns shows a company's commitment to quality and service. High customer satisfaction levels can lead to increased loyalty and repeat business.

Governance Metrics

1. Board Composition

Evaluating the diversity and independence of board members ensures a range of perspectives in decision-making. A well-composed board strengthens corporate governance and accountability.

2. Ethical Practices

Corruption, bribery, and corporate ethics policies should be reviewed as they are vital for maintaining integrity. Upholding ethical business practices ensures that decision-making aligns with moral principles and legal standards. Strong ethical practices build trust with stakeholders and protect the company's reputation.

3. Executive Compensation

Analyzing the alignment of executive pay with company performance ensures fairness and motivates leadership to achieve long-term goals. Transparent compensation practices are key to stakeholder confidence.

4. Shareholder Rights

Ensuring that shareholders have a voice in critical decisions reflects good corporate governance. Protecting shareholder rights fosters trust and encourages investment.

5. Regulatory Compliance

Monitoring adherence to laws and regulations is essential for avoiding legal issues and fines. Proactive compliance demonstrates a company's commitment to lawful and ethical operations.

By focusing on these ESG metrics, companies can effectively report on ESG performance, address ESG factors, and align with standards set by organizations like SASB and ISSB. This comprehensive approach to ESG initiatives supports sustainable business practices and meets stakeholders' expectations.

Implementing ESG Metrics in Business Operations

Integrating ESG metrics into business operations is crucial for aligning with sustainability goals. It also helps meet stakeholder expectations. By embedding these metrics, companies can manage ESG risks and opportunities. This approach enhances overall performance.

Integrating ESG metrics into business operations is crucial for aligning with sustainability goals. It also helps meet stakeholder expectations. By embedding these metrics, companies can manage ESG risks and opportunities. This approach enhances overall performance.

1. Integration Strategies

Incorporating ESG metrics into business models involves embedding ESG factors into strategic planning and decision-making processes. This ensures sustainability considerations and specific ESG goals become integral to daily operations and company culture. Addressing the aspects of ESG in strategy helps businesses proactively manage ESG risks and opportunities.

2. Data Collection and Management

Advanced tools and software are essential for accurate ESG data collection and analysis. Companies can use specialized platforms to manage and report ESG metrics. These platforms support global reporting standards, ensuring transparency. Effective data management helps prioritize ESG reporting and align business practices with sustainability goals.

3. Stakeholder Engagement

Engaging stakeholders, including investors, employees, and customers, is vital for understanding their ESG considerations. Regular communication and reporting on ESG initiatives help companies address stakeholder expectations. This builds trust and highlights the importance of ESG investments in driving long-term value.

4. Continuous Monitoring and Improvement

Regular assessments of ESG performance enable companies to identify areas for improvement. Monitoring ensures that ESG goals adapt to evolving ESG risks and opportunities. It keeps ESG metrics aligned with business objectives and stakeholder demands. Continuous evaluation also reinforces that ESG metrics are important for sustainable growth.

5. Transparent Reporting

Clear and consistent ESG reporting is critical for maintaining accountability. Companies can use frameworks like the Global Reporting Initiative (GRI) to standardize disclosures. This approach enhances comparability and credibility in reporting on ESG, ensuring alignment with global reporting standards. Prioritizing ESG reporting builds trust and supports sustainable business practices.

By adopting these strategies, companies can integrate ESG metrics into their operations. This fosters sustainable practices and strengthens stakeholder relationships.

Commercial Benefits of ESG Metrics

Implementing ESG metrics offers several commercial advantages for companies of all sizes. Focusing on environmental, social, and governance aspects helps businesses improve their market position and financial performance.

1. Investor Attraction

Strong ESG performance attracts socially conscious investors. Organizations that effectively manage ESG factors appeal to those seeking sustainable and ethical investments. By showcasing top ESG metrics, companies of all sizes can enhance their appeal and secure increased ESG investments.

2. Competitive Advantage

Leveraging ESG commitments helps businesses stand out in the marketplace. Adopting sustainable business practices meets consumer demand for responsible products. For example, adopting a circular business model. This differentiation strengthens a company’s position and reinforces its role as a pillar of ESG in its industry.

3. Regulatory Compliance

Adhering to sustainability regulations like the CSRD and the Corporate Sustainability Due Diligence Directive (CSDDD) ensures companies meet legal requirements. Proactive compliance with these directives demonstrates transparency in the organization’s ESG practices. It also highlights the company’s commitment to ethical operations and effective governance issues.

4. Cost Reduction

Using ESG metrics can significantly reduce costs. Adopting a circular business model lowers resource consumption and minimizes waste, directly benefiting the bottom line. Efficient resource management, aligned with sustainability reporting goals, further supports long-term financial health.

5. Enhanced Reputation

Prioritizing ESG considerations improves public perception. Taking responsibility for reducing the impact of carbon emissions builds trust with stakeholders. Consistent efforts in sustainability reporting enhance loyalty and strengthen the company’s brand.

6. Access to Capital

Strong ESG performance improves access to capital. Financial institutions increasingly evaluate governance issues and sustainability reporting when approving loans or investments. Companies with robust ESG metrics and a clear focus on PAAS (Product-as-a-Service) often secure better financing terms.

Organizations can achieve these commercial benefits by integrating ESG metrics into their operations. This positions them for long-term success in a sustainability-focused market.

Challenges and Solutions in ESG Metrics Adoption

Adopting Environmental, Social, and Governance (ESG) metrics poses several challenges for organizations. Addressing these challenges is crucial. It also helps integrate ESG considerations into business operations. Overcoming these obstacles improves performance and risk management.

1. Standardization Issues

The lack of harmonized ESG reporting standards leads to inconsistencies across industries. This makes comparing and assessing ESG performance difficult. Organizations can adopt frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB). These frameworks ensure consistency in reporting specific ESG metrics and align with global practices.

2. Data Accuracy

Ensuring reliable ESG data is a major challenge. Implementing third-party audits and verification processes improves data credibility. Companies can also use advanced data management systems to maintain accuracy. This supports effective sustainability reporting and transparent handling of ESG issues.

3. Continuous Improvement

ESG issues and societal expectations constantly evolve. Organizations must update their ESG strategies regularly to meet new requirements. Aligning with circular economy principles or a closed-loop system strengthens ESG efforts. Setting up an ESG committee helps track developments and make necessary adjustments.

4. Regulatory Compliance

Navigating complex ESG regulations, like the Corporate Sustainability Reporting Directive (CSRD), is challenging. Proactive compliance helps companies meet legal standards and avoid penalties. Addressing extended producer responsibility as part of compliance shows a commitment to sustainability and ethical operations.

5. Resource Allocation

ESG initiatives need significant resources, including time, money, and personnel. Companies must divide these effectively to align with their ESG goals. Developing a roadmap that includes sustainability reporting benefits and prioritizes objectives ensures optimal resource use.

6. Stakeholder Engagement

Engaging stakeholders with diverse expectations can be difficult. ESG involves fostering trust and transparency through open communication. Actively including stakeholders in the ESG process ensures efforts are inclusive. It also addresses all critical aspects of ESG performance.

By addressing these challenges, organizations can integrate ESG metrics into operations effectively. This aligns them with financial reporting standards and improves performance and risk management.

Build Trust Through ESG Reporting Excellence with Report Yak

ESG metrics are a cornerstone of ESG reporting and sustainable business practices. They help businesses measure environmental, social, and governance performance. This provides insights that build stakeholder trust and support long-term success. By aligning with global frameworks like the International Sustainability Standards Board (ISSB) and the Sustainability Accounting Standards Board (SASB), companies ensure consistency, transparency, and compliance with evolving regulations such as the Corporate Sustainability Reporting Directive (CSRD).

The commercial benefits of ESG metrics are clear. They help attract investors, stay competitive, follow regulations, and cut costs. Strong ESG strategies improve market position, boost finances, and promote a circular economy. Solving challenges like standardization, data accuracy, and stakeholder engagement is key to using ESG metrics effectively and reaping sustainability benefits.

For top-notch ESG reporting, collaborate with Report Yak, India’s best ESG and sustainability report design agency. Check out our Showcase featuring our LACP Spotlight award-winning ESG, sustainability, and annual reports. Visit our Services page to learn more about what we do.

For assistance, call us at 1800 121 5955 (India), WhatsApp, or email contact@reportyak.com. Prefer online? Fill in our Contact Form on the website, and we’ll reach out promptly! Let’s make your ESG reporting impactful and effective.

Related Posts

-

Integrated Reporting Made Easy For Modern Companies

annual reportAnnual Report design

+6

Dec 31, 2025Share

Copy Url

How To Adopt BRSR Guidelines For Success

Oct 15, 2025Share

Copy Url

Simplifying ESG Disclosure for Better Impact

corporate reportingenvironmental and social initiatives

+6

Aug 28, 2025Share

Copy Url