How To Adopt BRSR Guidelines For Success

Share

Share

Copy Url

Copy Url

When it comes to corporate reporting in India, BRSR guidelines have quickly become the talk of the town. Introduced by SEBI, these guidelines bring a structured way for listed companies in India to disclose how responsibly they run their businesses. The idea is simple: show how your business practices align with sustainable development and ethical business principles. But don’t be fooled, while the BRSR guidelines make reporting more transparent, they also demand attention to detail.

At its heart, this framework is built on the principles of the National Guidelines on Responsible Business Conduct. It asks companies to disclose key information using a specific BRSR format. This includes management and process disclosures as well as performance indicators. It also reviews how organizations engage with value chain partners, measure greenhouse gas emissions, track energy consumption, and provide value to their consumers. In short, it connects business responsibility with sustainability in a very real way.

For companies, the benefits of BRSR reporting are twofold. It builds trust with stakeholders through clear ESG disclosure. It also positions them better in a market that rewards sustainable business practices. The detailed BRSR reporting format, with leadership indicators and essential indicators, gives investors and regulators a sharper view of ESG performance. Since the framework in India aligns with globally recognized sustainability reporting frameworks like the Global Reporting Initiative, companies gain credibility on an international stage.

What Are BRSR Guidelines, and How Did They Emerge?

BRSR stands for Business Responsibility & Sustainability Reporting. It is a reporting framework by SEBI. Under it, listed companies must disclose ESG data in a structured way. It merges disclosures about social, environmental, and governance matters.

The story of BRSR guidelines starts with India’s growing need for clear ESG reporting. Over time, the country moved from voluntary principles to stricter mandates. This shift shaped how Indian companies disclose sustainability and responsibility. In this section, we explore how BRSR came to be, why SEBI plays a central role, and what gaps BRSR fills.

Over years, the role of reporting shifted from voluntary to mandatory. The changes reflect stronger expectations from investors and regulators.

SEBI’s Role & Regulatory Basis

SEBI (Securities and Exchange Board of India) is the stock market regulator. It mandated BRR in 2012 for top listed firms. Later, SEBI introduced BRSR in May 2021 as a new ESG disclosure regime. It required the top 1,000 listed companies by market cap to adopt BRSR from fiscal year 2022–23 onward.

SEBI provided the BRSR format and guidelines, aligning disclosures with global frameworks such as GRI (Global Reporting Initiative).

Why Replace BRR? Gaps That BRSR Fills

BRR had limitations. It was more voluntary in spirit and often lacked depth and comparability.

Here are key gaps BRSR addresses:

More metrics & detail: BRSR requires quantitative disclosure across environment, social, and governance axes.

Standardization & comparability: With BRSR, companies follow a uniform reporting format. This helps investors compare ESG performance.

Value chain and assurance aspects: BRSR digs deeper into upstream/downstream disclosures.

Leadership indicators: Beyond essential (mandatory) ones, BRSR gives optional “leadership indicators” to encourage better ESG performance.

Better alignment with global reporting: BRSR is designed to align with accepted reporting frameworks like GRI. This helps with international credibility.

Who Must Comply and When (BRSR Applicability)

Not everyone needs to file a BRSR report, at least not yet. The BRSR guidelines currently apply to a select group of listed Indian companies. But over time, more firms may join. In this section, we look at exactly which companies must comply, when they must do so, what “voluntary adoption” means, triggers for applicability, and what happens if you miss the deadline.

Who Must Comply: Which Companies

SEBI has mandated that the top 1,000 listed companies by market capitalization must file a BRSR report as part of their annual report. These are companies with large size, wide investor interest, and greater ESG risk exposure.

Other listed or unlisted firms may choose voluntary adoption of BRSR reporting. This means they follow the BRSR reporting format, though they are not legally required to do so yet. Voluntary firms can gain transparency, better ESG disclosure, and investor goodwill.

Phase-in Schedule (When It Rolls Out)

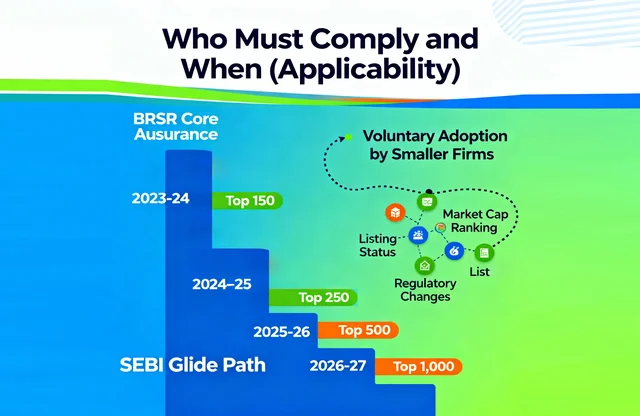

SEBI has set a glide path (phase-in) to ease the burden of full implementation.

By FY 2026-27, all 1,000 have to carry out BRSR Core disclosures with assurance or assessment. Also, value chain ESG disclosures are being introduced gradually. For some years, they remain voluntary or “comply or explain.”

Triggers for Applicability

Here are typical triggers or criteria that make a firm subject to BRSR compliance:

- Market capitalization ranking - being among the top 1,000 listed firms.

- Listing status - being listed on recognized stock exchanges.

- Regulatory updates - when SEBI issues new rules or formats (for example, the BRSR Core circular published July 2023).

- Change in company size or capital base - firms may enter or exit the top 1,000 over years.

- Voluntary decision - a company may choose to adopt BRSR as part of ESG or branding strategy.

- Consequences of Non - Compliance or Delay

What if a company fails to file or delays compliance?

- Regulatory action: SEBI could take steps under the Listing Obligations & Disclosure Requirements (LODR).

- Investor distrust: Lack of ESG disclosure or lapses can erode stakeholder confidence.

- Reputational risk: Missing deadlines or weak reporting may label a firm as opaque or non-transparent.

- Comparative disadvantage: Peers with good ESG disclosure may attract better capital, ratings, or partnerships.

- Audit/assurance issues: Late or incomplete reporting may lead to negative findings by third-party assessors or auditors.

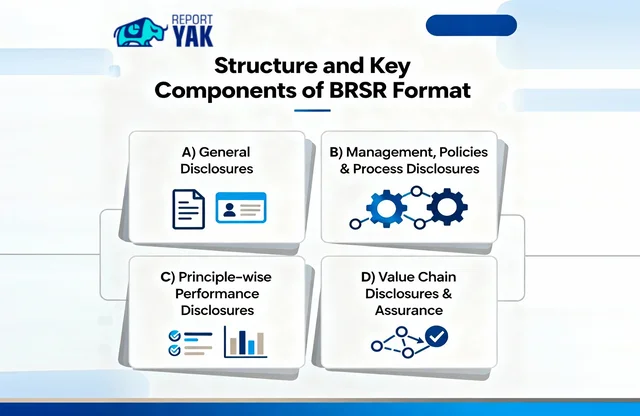

Structure and Key Components of BRSR Format

The BRSR guidelines aim to create a clear, layered reporting structure. The format is divided into distinct parts so readers and stakeholders can see everything, from basic facts to deep ESG metrics. Below is how the framework is built.

A. General Disclosures (Section A)

This is the opening section. It covers basic corporate and operational data. Think of it as your company’s ID card. You typically report:

- Corporate identity number (CIN)

- Registered address and contact info

- Reporting boundary (which subsidiaries, locations)

- Markets of operation (domestic, international)

- Number of employees, workforce breakdown

- Turnover, revenue segments, business segments

- Risk exposures, ethics and compliance statements

- Stakeholder engagement approach, supply chain outline

This gives readers context - who you are, where you operate, what scale you have.

B. Management, Policies & Process Disclosures

Here, you show how you run the business responsibly. You talk about governance, policies, and oversight. For example:

- Board roles and responsibilities, committees (audit, CSR, ESG)

- Policy adoption and review procedures

- How the policies are implemented across functions

- Mechanisms for monitoring, audits, internal checks

- Grievance redressal, stakeholder feedback loops

It also connects to the NGRBC principles (National Guidelines on Responsible Business Conduct). You explain how policies and processes reflect those nine principles, like respect for human rights, environmental care, and ethical conduct.

C. Principle-wise Performance Disclosures (Section C / BRSR Core)

This part is the “meat” of the report. You map your performance against the nine principles:

- Businesses should conduct ethically

- Products and services align with environmental goals

- Businesses should promote sustainability

- Employee well-being

- Stakeholder inclusivity

- Respect environment, resource efficiency

- Responsible business in value chain

- Public policy engagement

- Customer value and transparency

Within that, separate essential indicators (mandatory metrics) from leadership indicators (voluntary, aspirational metrics).

Then comes ESG metrics:

- Environment: greenhouse gas emissions (Scope 1, 2, maybe 3), water use, energy consumption, waste generation and recycling

- Social / Human: employee diversity, labor conditions, human rights issues, training, safety, welfare

- Governance / Stakeholder: board independence, anti-corruption, transparency, stakeholder engagement, reporting standards

These metrics let investors and regulators see how you perform on ESG, using a consistent format.

D. Value Chain Disclosures & Assurance

This section bridges your core operations and the broader network you depend on.

- Value chain disclosures: You include upstream suppliers or downstream partners’ ESG data where attributable. These may be on a “comply or explain” basis initially. Over time, this becomes more binding.

- You must state what share of purchases or sales the value chain data covers.

- Assurance / Assessment: For BRSR Core metrics, SEBI requires a third-party verification (reasonable assurance or “assessment”) in phases.

- The timeline: assurance on core disclosures first, later for value chain disclosures.

Over time, the formats and disclosure rules evolve (e.g. new leadership indicator for green credits) to keep the Sustainability reporting standards robust.

Benefits and Risks of Adopting BRSR Guidelines

Adopting the BRSR guidelines brings both opportunity and caution. In many ways, it's like planting a fruit tree - you invest now, and later you harvest benefits, but you must also guard against pests. Below, we explore the upsides and downsides that companies should weigh.

Benefits: Why the Investment Often Pays Off

Better Investor Confidence & Trust

When companies provide clear ESG disclosure through a business responsibility and sustainability report, investors feel safer. They can compare ESG performance across firms thanks to the common format. This transparency builds reputation and grows stakeholder trust.

Stronger Brand and Competitive Differentiation

Early adopters get noticed. In a market where sustainable business practices matter, BRSR reporting gives a firm a head start. It can attract customers, partners, and capital who favor ethical business.

Alignment with Regulation & Global Standards

BRSR helps companies stay in sync with SEBI’s evolving ESG requirements and aligns with major global reporting frameworks (like GRI). That reduces friction if firms expand overseas or deal with global investors.

Risk Mitigation & Resilience

By digging into ESG issues such as emissions, water use, waste, labor practices, companies can spot weak spots early. That helps avoid regulatory penalties, rating downgrades, or claims of greenwashing.

Long-Term Value vs Short-Term Cost

Sure, setting up systems, data processes, audits, and internal capacity costs money and time. But over time, the benefits of sustainability reporting such as better capital access, improved operational efficiency, brand value, can outweigh the initial effort. Some firms see cost savings from waste reduction or energy efficiency triggered by ESG focus.

Risks & Pitfalls: What to Watch Out For

Greenwashing & Credibility Risk

If you make grand claims in ESG but fail to back them up, or your data is sloppy, stakeholders will call it out. That can hurt reputation more than not reporting at all.

High Implementation Costs

Smaller or mid-sized companies may struggle with the investments in systems, reporting tools, staff training, and data collection across operations and value chains.

Regulatory Penalties & Compliance Pressure

As SEBI tightens rules, firms that lag may face penalties under listing obligations or LODR compliance regimes.

Rating Downgrades & Investor Disappointment

Poor ESG performance or late disclosures may lead rating agencies to downgrade the company or investors to withdraw. Loss of funding or higher borrowing costs can follow.

Burden of Value Chain Reporting

Collecting ESG data from upstream and downstream partners, many of whom are small and unlisted, can be hard. The costs and complexity may burden the reporting firm.

Hypothetical Example: Cost vs Return Trade-off

Imagine Company A, a mid-sized manufacturer, spends ₹1 crore in year one to build data systems, hire ESG staff, and audit its operations. In year two, it wins a large export contract because its buyers demand sustainable suppliers. That deal brings in ₹5 crore extra net over the next 3 years. So the return significantly outweighs the upfront cost.

On the flip side, Company B skips strong validation, has sloppy disclosures, and is accused of greenwashing. Its stock dips, and it loses investor trust. The reputational cost may far exceed what it saved in reporting costs.

How to Implement & Improve BRSR Reporting

Implementing strong BRSR reporting feels like building a sturdy home. The foundation must be solid, then you add walls, rooms, polish, and finally decor. In this section, we walk you through the major steps, from assessing gaps to picking an expert agency like Report Yak.

A. Gap Assessment & Baseline Audit

Start by comparing your current practices against the BRSR requirements. Build a matrix that lists all BRSR components (General Disclosures, Management & Process, Principle-wise Performance, Value Chain, Assurance) against your existing disclosures. In the matrix, note which items are fully met, partially met, or missing. This gives you a baseline audit and highlights your biggest gaps.

B. Data Systems, Processes & Internal Capacity

Once you know your gaps, you need systems and capacity to fill them.

- Data collection: gather data from internal units (operations, HR, environment) and from your value chain (suppliers, distributors).

- Tools: spreadsheets, ESG software, data dashboards, IoT sensors (for emissions, energy) might help.

- Roles & training: choose data owners in departments, train them on ESG disclosure and metrics.

- Controls: set checks so data is validated, audited, and cleansed before reporting.

C. KPI Target Setting, Tracking & Reporting Systems

You pick KPIs (essential and leadership) per principle. Then you set targets (year-on-year, absolute or relative). Build a system to track those KPIs monthly or quarterly. Link them to your reporting format so data flows seamlessly into BRSR tables. Use dashboards or simple visual reports for management review.

D. Assurance, Verification & Stakeholder Review

Core BRSR metrics need external assurance (reasonable assurance path). You must choose an auditor/assessor to verify data and method. Later, expand assurance to value chain disclosures. Also, share drafts with stakeholders (investors, NGOs, community) and collect feedback to improve clarity and trust.

E. Continuous Improvement & Benchmarking

Don’t treat your first BRSR as a “one-time job.” After publishing, benchmark your KPIs against industry peers or global best practices. Use audits and stakeholder feedback to refine data collection and targets. Iterate and improve year after year.

F. Role of an Expert Agency (Like Report Yak)

Working with a specialist can ease your path.

- Services offered: gap assessment, data system design, KPI selection, report writing, value chain mapping, ESG consulting, assurance liaison.

- Acceleration & quality: they bring experience, templates, domain knowledge. They reduce trial-and-error, speed up adoption, and ensure you meet BRSR requirements well.

- Choosing an agency: look at their track record (how many BRSR reports done), domain knowledge (ESG, sustainability), references, team strength, cost structure, and how well they understand Indian regulation (SEBI, disclosure norms).

Common Challenges & Mitigation Best Practices

Even when you try your best, adopting BRSR guidelines can feel a bit like climbing a mountain in the dark. You might stumble over hidden rocks or face unexpected winds. Below are common challenges many Indian companies meet. Then, we explore ways to reduce their impact so your climb is smoother.

Common Challenges

Data Gaps & Lack of Systems

Many firms don’t have full historical data on emissions, energy, or water. Some use manual spreadsheets across departments. This leads to missing, inconsistent, or unverifiable numbers.

Inconsistent Reporting Across Units or Value Chain

Parts of the company may report differently (one factory tracks water, another doesn’t). Suppliers or downstream partners may not cooperate or lack data systems. That causes gaps in value chain reporting.

Assurance Cost & Audit Limitations

Getting third–party assurance is expensive and not all assurance providers have ESG expertise. Some audits may yield weak caveats or limited scope.

Stakeholder Skepticism & Credibility Issues

If your disclosures are vague or seem polished without substance, stakeholders may doubt them. Greenwashing accusations hurt reputation more than silence.

Changing Regulatory Updates (Keeping Up with SEBI)

The rules evolve. SEBI may tweak BRSR format, value chain thresholds, or assurance requirements. Staying current is a challenge.

Mitigation Best Practices

Phased Adoption

Start small. Adopt the essential indicators first and gradually add leadership metrics. This eases cost and complexity.

Pilot Projects

Test ESG tracking in one plant, region, or business unit. Learn from it. Then scale to the full company.

Capacity Building

Train internal teams in ESG, data collection, methodology. Build a central ESG function or cell so knowledge stays in-house.

Strong Governance

Set clear accountability: assign board oversight, ESG committee, data owners. Use consistent policies across units.

Bring in Third-Party Support

Consultants or sustainability agencies help with report design, assurance readiness, methodology. They bring domain knowledge and past experience, reducing trial-and-error.

Why Partnering with Report Yak Helps

In simple terms, BRSR guidelines give Indian companies a clear way to tell their sustainability story. The BRSR framework links strategy, data, and action in one business responsibility and sustainability report. It improves ESG disclosure, comparability, and trust. It also aligns with global reporting framework practices while keeping focus on listed companies in India and their value chain. When used well, the BRSR format and its essential indicators and leadership indicators turn intent into measurable progress.

Of course, getting there takes work. Robust data, clean processes, and assurance requirements for BRSR Core matter. So does plain language that stakeholders understand. This is where Report Yak adds speed and quality. We design reports that read well, look polished, and stand up to scrutiny. We design credible, elegant reports that meet BRSR reporting guidelines and still feel human. Our team brings ESG know-how, tight editing, and strong visual systems. We also handle Annual Reports, Integrated Reports, and Sustainability Reports with equal care. We also map KPIs, refine disclosures, and streamline sections so boards, investors, and regulators can read fast and act faster.

If you want a report that stands up to scrutiny and stands out, let’s talk before your next reporting cycle begins. Email contact@reportyak.com or call 1800 121 5955. WhatsApp us or get on our website and fill in the Contact Form with your details. We’ll shape a credible, confident story, grounded in BRSR reporting guidelines, and make your performance easy to understand without losing depth.

Related Posts

-

Simplifying ESG Disclosure for Better Impact

corporate reportingenvironmental and social initiatives

+6

Aug 28, 2025Share

Copy Url

GRI Sustainability Taxonomy: Learn How to Turn Data Into Advantage

corporate governancecorporate reporting

+11

Jul 1, 2025Share

Copy Url

See How Components of an Annual Report Drive Business Confidence

annual reportAnnual Report design

+7

Jun 24, 2025Share

Copy Url